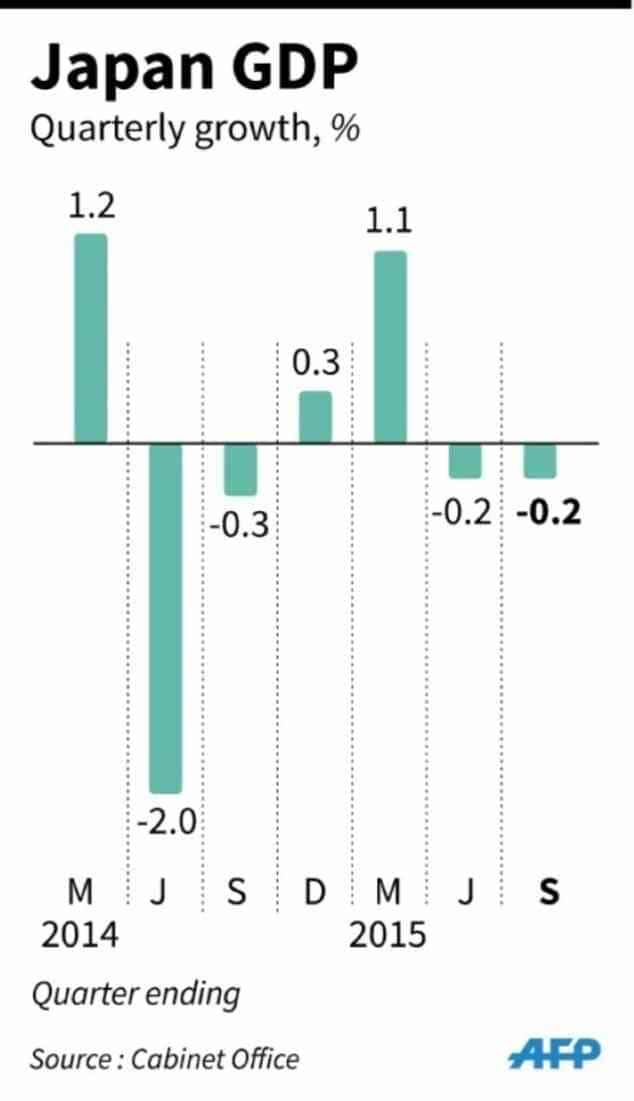

Japan: Country’s Economy Falls Back Into Recession as GDP Shrinks by 0.8 Percent in 3rd Quarter:

The market has contracted for a second straight quarter, following a revised 0.7 percent drop in April through June. Japan has been in downturn four times since the worldwide monetary catastrophe.

Since Prime Minister Shinzo Abe came to power almost three years back, Japan’s market fell into recession for the 2nd time, data revealed Monday, dealing a fresh blow to his drive to ending years of deflation and kickstart poor increase.

Abe has staked his reputation on a policy blitz of competitive monetary policy easing financial spending and structural reforms — dubbed Abenomics — aimed at restoring the world’s third-biggest market

Japan’s market Asia’s largest, has been overtaken by giant neighbour China in size, while it fights with a challenging demographic prognosis that’s anticipated to find its population decrease by the tens of millions in coming decades.

However, it boasts a number of the largest businesses of the world’s, including in banks and the automotive sector, and its own domestic technology plays an important role in a variety of international businesses, including high end machinery, electronic equipment and vehicles.

The market contracted in 2014 after their belts tightened following a rise in the consumption tax, which put a dent in a nascent restoration of the country’s.

That decline spurred its already substantial bond to dramatically raise -purchasing programme, efficiently printing money to spur financing.

But, the government somewhat enhanced its April-June data to a 0.2 percent contraction from 0.3 percent shrinkage formerly estimated.

The most recent figures will turn focus back to the BoJ ahead of a policy meeting this week ($653 billion) yearly stimulation programme.

With enhancing consumption countered by weakening corporate investment due to doubt over the world-wide prognosis, especially Chin the data provide a blurry picture of the market, specialists said.

“Businesses are hesitant to invest despite their sound gains,” he said, adding that while consumer spending enhanced “its entire tendency still remains poor”.

Akira Amari, the government minister in charge of revitalising the market, put a mostly favorable spin on the result, saying in a statement the “business climate is anticipated to recover slowly”, mentioning increasing wages as a glowing variable.

However he openly expressed discouragement against companies that have shied away from making new investment.

“Having made record gains, with their gear becoming older, what type of company choice is it to still forgo investment?”

The benchmark Nikkei 225 stock index dropped 0.97 percent by the rest, with the Paris terror strikes adding to investor unease in Asia.

However, analysts generally expect the market to pick up in coming quarters, with the BoJ seen further easing monetary policy and Abe tipped to unveil an original stimulation package.

“Details aren’t as poor as the amounts might indicate,” Junichi Makino, economist at SMBC Nikko Securities, said in a note, mentioning declines in stocks and rising imports.

For technical reasons GDP adversely affects but can in fact mean rising demand.

But Marcel Thieliant, economist at Capital Economics, said any retrieval ought to be seen with caution.

Thielient said he anticipated the BoJ to hold off further easing for now but enlarge it early next year, with a January assembly being “the most likely place for its statement”.

source: via